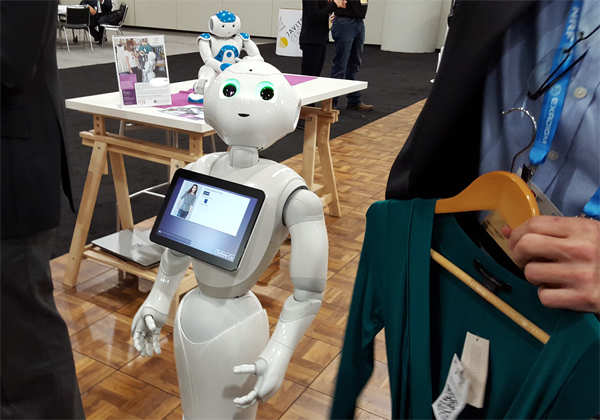

FRUSTRATED WITH STORE EMPLOYEES? Maybe a mechanical clerk is the answer.

The retail industry today is making some fascinating, promising, and perhaps troubling moves toward the routine use of autonomous retail robots in human environments. The efforts seem energized by technical advances, affordability gains, and increasing wages for their human counterparts.

“Everybody is beginning to talk about robotics as a way to remove labor from the system,” said David Marcotte, a senior vice president with consulting firm Kantar Retail, a friend of this blog, in an interview in the Star Tribune newspaper.

As a confirmed sci-fi geek (occasionally prone to paranoid fantasy), I’m both fascinated and a bit leery about this development. There’s little doubt, however, that the robots are coming to retail from numerous directions.

Tenser’s Three Laws of Retail Robotics:

1 – A retail robot may not harm, mislead or impede a shopper, or, through inaction, allow a shopper to fail to complete a sale or have an otherwise poor experience.

2 – A retail robot must faithfully implement the merchandising plans given it by retailers except where such orders would conflict with the First Law.

3 – A retail robot must encourage and protect the sale, as long as such protection does not conflict with the First or Second Law.

(Adapted with great reverence from i Robot, by Isaac Asimov.)