NOT LONG AGO I WAS ASKED to prepare a “Best Practice” document for a retail solutions company. The task stimulated a round of research, investigation and deep thinking.

Best Practice is a term we invoke fairly often in the retail consumer products industry. Industry associations devote considerable resources to identifying them. Consulting firms convene their best subject matter experts to define and explain them. (Sometimes they invent them outright.) Sales organizations, especially, like to invoke them as evidence of the superiority of their solutions.

But is there consensus on the real meaning of best practice? Well I read up on what some of the experts had to say and added some original thinking of my own. Here’s what I came up with:

Best Practices are the reusable practices of the organization that have been shown to be successful in their respective functions. To make them repeatable and consistent, they are defined by the organization and institutionalized in various ways, often enabled by technology systems. Best Practices may deliver great value in driving customer experience, workflow efficiencies, speed, accuracy, reduced re-work, cost control, operational insights, business improvement and other benefits.

While specific Best Practices may vary across different organizations and industries, some tend to rise consistently to the top. Those worthy of the adjective “best” tend to reflect five key traits: They are Designed, Conscious, Measurable, Realistic, and Customer-Focused.

Read more

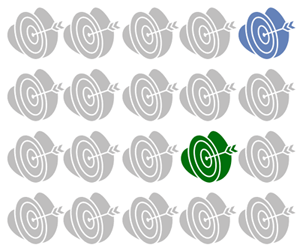

BEST PRACTICE IN MOBILE ADVERTISING remains an oxymoron, as marketers grapple with the natural tension between intrusiveness and usefulness. There is a strong drive to justify ad spending and validate the business premise behind personalized promotions. Relevance seems to be the key, we are told, and the unique data-capturing and consumer-tracking capabilities of mobile devices should materialize a marketer’s nirvana in which every message is on-target and welcomed.

BEST PRACTICE IN MOBILE ADVERTISING remains an oxymoron, as marketers grapple with the natural tension between intrusiveness and usefulness. There is a strong drive to justify ad spending and validate the business premise behind personalized promotions. Relevance seems to be the key, we are told, and the unique data-capturing and consumer-tracking capabilities of mobile devices should materialize a marketer’s nirvana in which every message is on-target and welcomed.