IS “SOCIAL MEDIA FOR BUSINESS” an oxymoron?

IS “SOCIAL MEDIA FOR BUSINESS” an oxymoron?

One current LinkedIn Groups discussion loudly and repetitively (2,500 posts and counting!) declares it “CRAP.” I think this oversimplifies what has become a marketing imperative, and clouds a very important opportunity.

As new marketing verbs like tweet, blog, and social networking permeate our thinking, we need to acquire a clarifying thought vocabulary that will allow us to grapple with emerging concepts and put the tools to appropriate and beneficial use. I’ll take a first whack at it here. Perhaps some wise readers can build on these ideas.

For starters, it would be helpful to differentiate between the kinds of activities that take place within online social media constructs. I group them into four familiar quadrants: C to C, B to C, C to B, and B to B.

“Consumer to Consumer” social media are probably the highest profile, as they are manifest on hundreds of millions of Facebook, MySpace, Twitter and YouTube uploads. The purpose here is primarily social and personal, and there’s certainly nothing wrong with that. If much of the content posted on virtual “walls” is silly, trivial and self-indulgent, so be it. It is also highly dynamic, interactive, and in its way, democratic. The sheer size of the community is proof of the concept’s power and cultural influence.

Businesses and political groups view the huge C to C audiences as a potential gold mine, and so there has emerged a concerted effort by marketers to deliver controlled messages within the social media platforms. I’d label activities like this “Business to Consumer.” Recent elections showcased this potential, as candidates used online groups, and “fan” pages to garner support, raise funds, and motivate voters. Brand marketers are also in hot pursuit of the social media audience, but they should be cautioned that quaint broadcasting norms may not apply here. Leading practitioners are working out ways to accumulate followers who are receptive to targeted messages and offers and whose responses may also be sources of useful insights.

Which leads us naturally to consider the arrow’s reversal: “Consumer to Business” social networking may be a source of valuable feedback from both supporters and critics. Ardent fan and cruel pan pages can spring up spontaneously – sometimes to the dismay of the brand, retailer or celebrity covered. The object of such public scrutiny typically has little control over its content, much less its veracity. This is a cold fact of life that marketers must simply learn to live with. Wise brands monitor these for insights and to counter libelous talk, but they respond with a light touch, so as not to elevate a lone crackpot into fodder for the salivating media.

Of course, brands, celebrities and pols also take deliberate action to invite communications from loyal and not-so-loyal constituents – setting up their blogs, Twitter feeds, email lists and fan pages to anchor the message and gather feedback. Perhaps B to C and C to B social media activities are inseparable, two sides of a coin.

B2BSM – A Different Animal?

Finally we have the distinct instance of Business to Business social media. This is my real interest in this discussion, actually, because it applies the tools and methods of social media to serious business purposes. LinkedIn is a very good example of a public platform that is used for career networking, personal branding, formation of subject matter communities (“groups”) and sharing current events and ideas. There is also some fairly sound (if experimental) use of Twitter by trade journalists and industry observers (search the #NRF10 hashtag on twitter.com to view interesting and extensive coverage of last week’s NRF Expo in New York, for example).

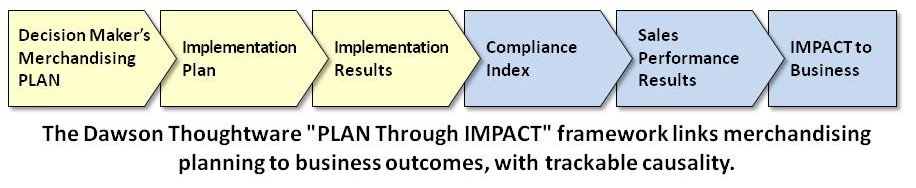

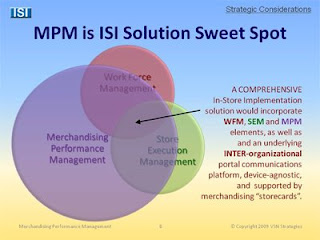

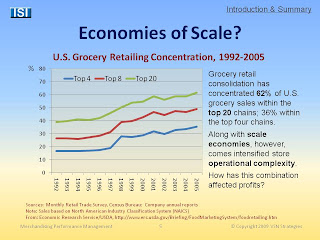

Another B2BSM realm is emerging around secure-access portals that incorporate social media-like tools. These are used for creating flexible online workgroups, sharing documents and information, even hosting internal and inter-organizational collaboration like Merchandising Performance Management among retailers and manufacturers. The platforms use some familiar functionality, but quickly go deeper to deliver performance dashboards, “fingertip analytics” and other advanced capabilities designed for decision-making experts who are not IT experts.

Some businesses are also using a combination of Web-based and social media applications and tools to manage their visibility, presence, and image with respect to their business community. The portfolio of tools may include any or all of the following: The firm Web site; blog; an email and list management service; a LinkedIn group; a Facebook company page; one or more Twitter or other microblog feeds; an online market research site like Survey Monkey; an online press release distribution tool like PRWeb, and more.

At VSN Strategies, we like to call coordinating this set of activities “management of the commercial online voice” or voxology for short.

Voxology in Practice

VSN WebVox™ is my firm’s name for this business service. We help clients combine multiple Web-based tools and services to create, maintain and propagate a commercial “online voice.”

We craft thematic consistency and interlink the elements to create a high level of Web activity that helps companies score high on search engines and expand their reputation. The result is an evolving Web presence – a combination of visibility and credibility, across the multiple linked channels of the Internet. Companies become more search-able, more find-able, more believed, more in contact, more heard.

At VSN we’re in the camp that firmly believes social media for business is definitely not “CRAP.” Furthermore we maintain that mastery of its subtleties is an essential pursuit for both B to C and B to B marketers. We’d like to see some improved vocabulary emerge to differentiate the activities that take place between individual consumers, businesses and consumers, and businesses with other businesses.

For B to B, I propose “voxology,” the new science of the online voice.