ONE OF THE SIDE EFFECTS of the “showrooming” panic which seems to grip some of America’s big box retailers has been a flood of learned and not-so-learned opinions from learned and not-so-learned analysts and observers.

Showrooming anxiety emerged during the 2011 holiday selling season, when chains like Target and Best Buy were revealed as victims. Shoppers were inspecting and comparing merchandise in their stores, then using mobile apps to find and order the desired items at lower prices from places like Amazon.com and Buy.com. The story had a second surge in media coverage during April, when Best Buy reported soft sales and the departure of its CEO Brian Dunn. There are too many articles to count about this. How important is it, really?

The Pew Internet & American Life Project reported Jan. 30 that about one fourth of shoppers had used a smart phone at least once to check a price in a store during the last holiday period. The release did not specify which types of products were checked most. I’d bet a month of sales that the skew was heavily toward high-consideration purchases like TVs and major appliances.

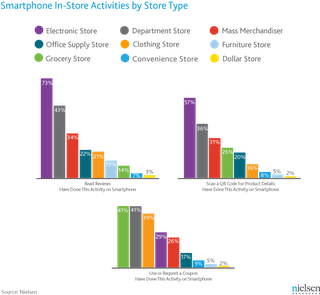

Nielsen recently released findings that suggest there is indeed a significant variation in impact of mobile device use across retail channels. Nearly three fourths of respondents said they used a smartphone to check prices on a consumer electronic item, while more than half said they had scanned a code with their phone in a CE store. This behavior was much less prevalent in most other product categories – but not zero.

The New Transparency

Clearly there is much more we need to understand about this shopper behavior complex — not only about how shoppers are altering their habits around certain purchases, but also regarding what brands and retailers should do about it.

To that end, DemandTec, an IBM Company, is now sponsoring a RetailWire survey with specific focus on how retail practitioners think brick ‘n mortar retailers should combat showrooming.This is a worthy undertaking with potential to help surface superior thinking about the new era of price transparency:

We’ll interpret findings from this study here later this summer.

Absent investigations like these, showrooming may remain a buzzword excuse used by unimaginative retailers to explain away their mediocre performance in the face of increasing price transparency. It’s already a hot-button headline word for the herd of analysts and reporters who interpret consumer behavior based on instinct rather then empirical analysis.

I’m concerned that retailers who focus too narrowly on defeating showrooming are at risk of actually defeating their own shoppers. I propose an alternative: Focus on helping them get the best deal possible — from your bricks or clicks.

It could be that showrooming is not all bad, if we pay systematic attention. It could be just the reality check you need on your price image that could enable early corrective action.

Retailers collect slotting, display, and promotional allowances from manufacturers in exchange for putting products on their shelves. In some sectors, the net profits from these activities exceed the net profits from sale of goods. A lost sale, while unfortunate, is not a fatal occurrence. And manufacturers may still have powerful incentives to pay allowances to physical retailers who put their products on display — even if some resulting purchases take place online.

© Copyright 2012 James Tenser

(This article was commissioned by IBM which is granted the right of republication. All other rights reserved.)