Measurement schemes are coming thick and fast from various groups claiming to have the last word on measurement of shopper media. At last count at least three groups were competing over this:

The P.R.I.S.M. (Pioneering Research for an In-Store Metric) project, originally organized by the In-Store Marketing Institute (www.instoremarketer.org) in 2006, has been an important catalyst for the marketplace. Now in phase II, a 26-week market test, the stated goal is to develop an “in-store GRP” or gross rating point, aimed at a identifying a comfortable metric for the media buying establishment. With strong support from Nielsen In-Store and numerous large brand marketers and ad agencies, P.R.I.S.M. is a leadership voice in establishing a standard for store-level data.

Not to be outdone, OVAB, the Out-of-home Video Advertising Bureau, (www.ovab.org) released its Audience Metrics Guidelines report in August. The report advocates an “average unit audience” principle for measuring digital media in various physical settings that incorporates both opportunities to see and variable units of viewing time appropriate to each viewing context.

POPAI, the Point-of-Purchase Advertising Institute, which bills itself as the “global association for marketing at retail,” (www.popai.com), released its report, Digital Signage. The Global Study. Opportunities and Risks in August in conjunction with the German association, GIM (Gesellschaft für innovative Martkforschung). The scope is broad – on the global digital out-of-home (DOOH) marketplace, and the focus is again largely on audience measurement.

In addition, Digital Signage Today (www.digitalsignagetoday.com) released a sponsored report, Measurement and analysis for digital signage, that explores audience measurement and proposes a multi-tier way of looking at in-store ad value, encompassing proof of ad delivery, proof of audience delivery and sales uplift. There’s promise in this approach, I think.

All these measurement studies attempt to bring welcome rigor to the realm of shopper media metrics. It’s widely understood now that simply counting the number of people who walk in the front door of a store does not adequately document an audience. Nor does it come close to reflecting its value to advertisers using an in-store network. P.R.I.S.M. has introduced a useful scheme for dividing a retail store into messaging “zones” or channels corresponding to merchandise departments and high-traffic power alleys. This is a welcome refinement versus a people-counter at the front door, but I think it’s only a step toward the ultimate requirement, a sales and ROI sensitive measurement system.

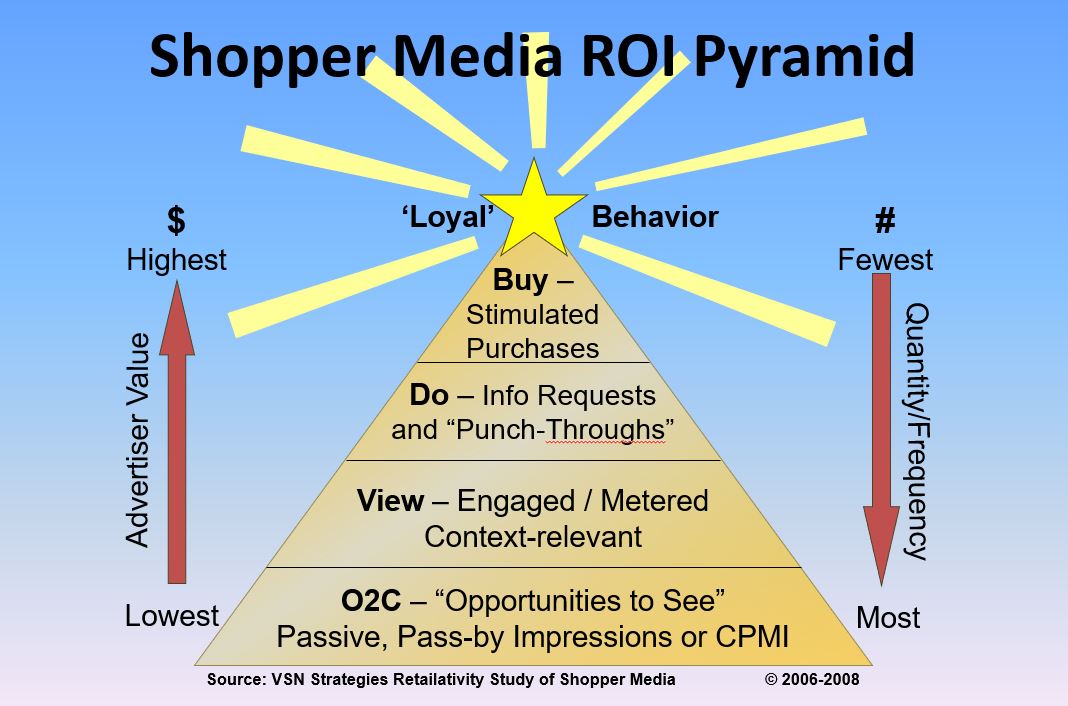

Audience metrics are necessary, but not sufficient. The Shopper Media ROI Pyramid, pictured here, presents a conceptual framework for a more robust value metric:

O2C: At the base are “opportunities to see” – communications that have reach and frequency only. This is what the PRISM initiative has learned how to measure in Cost Per Thousand Impressions. This is a metric best expressed in some analog to gross rating points (GRP). It reflects how many messages are sent and the theoretical size of their audience. O2Cs are cheap and plentiful – and, like “traditional” media, linked tenuously to actual sales lift.

View: Next up are views that can be actually proved. Some current shopper media are capable of metering actual views through use of electric-eye people counters, embedded cameras, shopping carts with embedded RFID tags, digital image analyses, etc. This is a “page view” metric, to use a Web metaphor – greater in number than O2C but still relatively low in individual value.

Do: Next up the scale are communications that stimulate some kind of interaction that might precede a sale. This may include pressing a touch screen for further information, taking a coupon or “take-one”, trying a sample. This is a “click-through” metric, fewer in number but of greater value to marketers.

Buy: Next up the pyramid are communications that may be directly related to product trial or sale. This “purchase” metric will be more scarce, but even more valuable.

Loyal Behavior: At the pinnacle are in-store communications that contribute not just to a single purchase but to enduring affective and behavioral change. We call this loyalty, and it is rarest and dearest of all. Loyalty may only be detected by a marketer with a plan – a frequent shopper card program or other longitudinal tracking mechanism capable of linking together multiple purchase events by the same shopper.

As a marketer, I would require that all these layers be measured and modeled so that I can truly understand the ROI of my in-store communications. As a retailer hosting these messages, I would require that I get paid in accordance to the value delivered at each of these levels. As an in-store network operator, I would seek a way to justify compensation at each level as well. As a brand marketer, I would pay almost any price for provable sales ROI metrics and probably donate a vital organ for reliable proof of loyal purchase behavior.

My opinion? Opportunities to see are a poor proxy for measuring sales lift and repeat purchase behavior. I’m unimpressed by in-store GRPs and believe shopper marketers will require direct ROI measures. If this prospect makes the media buying establishment feel a bit queasy, I say get over it. It’s a digital world. Sampling and averages reflect outdated, analog thinking.