Sure, you can plan alright, but how well can you implement?

Sure, you can plan alright, but how well can you implement?

I imagine this question keeps truly conscious merchants and consumer product marketers awake nights with what amounts to performance anxiety.

Those of you who follow the work of the In-Store Implementation Network may be well aware that members regard the pursuit of retail compliance as nothing less than an industry imperative. Our latest work on Merchandising Performance Management drives the point further. Our not-so-hidden agenda: Shift the dialog from hand-wringing about our challenges to identifying and implementing practical solutions.

You see, we are standing at the threshold of the next (maybe the last) great opportunity for retail financial performance gains – the stores themselves.

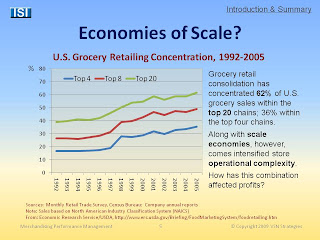

The past two decades of industry consolidation, supply chain advances and category management have failed to move the needle on basic merchandising performance indicators such as out-of-stock rates, promotion compliance and planogram compliance and decay. The numbers remain so disheartening that we routinely plan not to measure them. This despite their obvious causal link to GMROII and profits.

Here is evidence of what I call “dis-economies of scale.” It should be a source of more than a little vexation across the retail consumer products industry. Top executives know with certainty that buying clout and elimination of redundant processes are competitive necessities, but they prefer not to call attention to the fact that larger strings of larger stores are also much harder to steer.

Today’s fast-moving consumer goods chains teeter along the precipice of the “big middle” – the cold, dark place of persistent merchandising mediocrity ruled by a mythical, but non-existent, average shopper. Never fear – we’ve got Shopper Marketing to keep us from the abyss. We segment and target our customer base, and we study our targets, so we derive insights about our shoppers and make plans to reach them on their terms.

Those shopper insights let us design offers tailored to specific shopper groups. They are also inputs for automated planogram tools that let us design tailored merchandising plans for each category in each store. We can layer on store-specific pricing, using the latest optimization technologies, and before long we’ve defined thousands of store-specific matrices of space, mix, price points and deals.

Yes we have some impressively intricate plans, but can we implement them? Well, there’s a dizzying amount of detail to cover, but realistic solutions may finally be at hand.

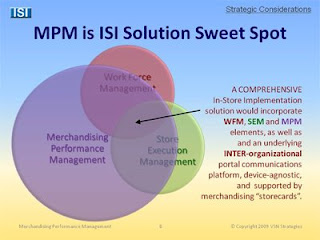

Retailers, manufacturers, brokers and merchandising services organizations have recognized for some time that they need a systematic way to parcel out the tasks to their minions in the field. That has led to a proliferation of home-grown and commercial Work Force Management (WFM) software solutions that permit headquarters to push instructions out to the individuals tasked with performing them.

WFM solutions are generally one-way (HQ to the field) and intra-organizational with an emphasis on employee management. That is, they permit managers to send instructions to their own people in the field without provision for feedback. Often those instructions arrive in the form of an email or memo.

Expanding the WFM principles more specifically to the retail environment has led to shift in focus from managing people to managing activities. Solutions of this type are called Store Execution Management (SEM), and they are oriented toward field force automation and task or process efficiency. A number of third-party MSOs and direct store delivery organizations deploy SEM solutions today. As a rule these too are intra-organizational, with limited feedback possible for the host retailer.

Now we are seeing a new class of solutions reach the market, of a type I like to call Merchandising Performance Management (MPM). They are distinct from legacy WFM and SEM solutions in several important ways. First, they are engineered to manage outcomes, not just tasks or people. Because they incorporate a two-way platform for feedback and reporting, they support capture of performance metrics in real time.

Second, they are inter-organizational by design. That is, they support interaction from all the parties who plan merchandising and who touch the merchandise in stores – retailers, manufacturers, MSOs, brokers. This is most commonly accomplished through establishment of a secure, Web-based portal that is accessible as an online service. As a result, all parties in the merchandising ecosystem view relevant performance data and contribute required feedback to the greater information flow.

Presently there are at least eight solution providers who offer MPM software and services to the retail market. Several are early-stage companies and relatively untested. None are perfect. All hold out the promise of a practical, every-day, plan-do-measure store compliance discipline that can find hidden profit in the stores – where it all started.

Intricacy is the enemy. Most of what we try to do is not that hard. But there is so much detail to cover and those details are so … relentless. Performance anxiety must inevitably follow.

Unless… We adopt sound Merchandising Performance Management practices. ISI Network has assembled a report that outlines some tools and options for senior executives. I encourage you to take a look. It’s good for what ails us.

The In-Store Implementation Sharegroup is expanding membership and redefining its mission. The decision follows the overwhelming response to the April 2008 release of the Working Paper, In-Store Implementation: Current Status and Future Solutions. To date, the group has received more than 600 inquiries and dozens of membership requests.

The In-Store Implementation Sharegroup is expanding membership and redefining its mission. The decision follows the overwhelming response to the April 2008 release of the Working Paper, In-Store Implementation: Current Status and Future Solutions. To date, the group has received more than 600 inquiries and dozens of membership requests.