MINDS WERE BLOWN last week when Amazon announced its intention to acquire Whole Foods Markets 461 locations in a $13.7B cash buyout. A media and analyst frenzy followed that has kept the world of retail business on edge for many days.

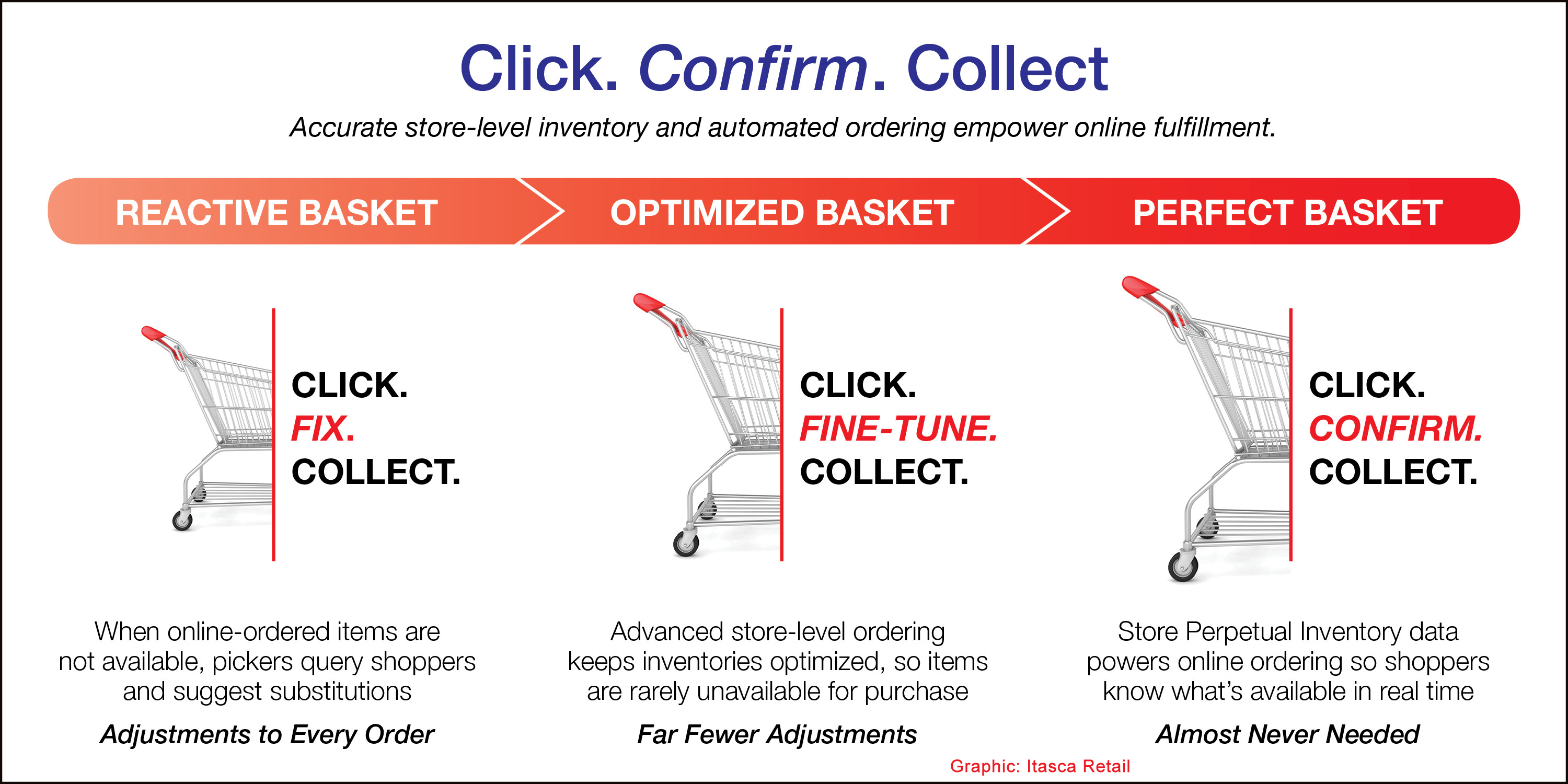

As it happens, your intrepid storyteller was already deeply involved in a project focused on the in-store fulfillment of online orders. Click & Collect has been coming on strong for many months. It seems like Amazon’s serial adventures with AmazonFresh Pickup, AmazonGo, Prime Now and Prime Pantry have been a primary catalyst. Obtaining a portfolio of physical stores is its most audacious experiment to date. Now the competition gets interesting.