ALMOST OVERLOOKED during the Autumn business conference-slash-election season was a nicely-done bit of research about the new price transparency.

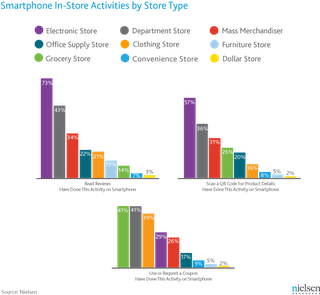

Prepared by RetailWire.com and underwritten by IBM Smarter Commerce, the study “Pricing Transparency: Can Retailers Regain Control?” was released October 5. It was conducted in an effort to better understand the phenomenon known as “show-rooming,” where shoppers use apps on their mobile phones to check merchandise prices while shopping in-store.

The study authors define “pricing transparency” as “The ability to learn the relative price positions of a particular item across competitive retailers.” The trend had some folks pretty nervous around mid-year, especially retailers who specialize in high-consideration purchases, like consumer electronics.

The findings indicated that Price Transparency falls mid-level on the continuum of general retailer concerns – below the economy, competition and consumer behavior. Considered among pricing practices, however, respondents did worry about consumer price sensitivity in general (ranked as #1 concern by 35%) and transparency in particular (ranked #1 by 21%).

Increased price sensitivity seems to be an enduring consequence of the recent protracted economic downturn. Many shoppers have re-evaluated their purchasing behaviors. Smart phone apps both enable and reinforce these behavioral changes.

Retailers have some effective defenses available beyond absolute lowest prices. Most are related to enabling shopper success in other dimensions. Superior, relevant assortment, exclusive items, and excellent item availability all can have a positive influence here, the findings suggest.

The best practice formula remains somewhat murky in the brave new world of transparent prices, but this research begins to make matters clearer. An Executive Summary of the “Pricing Transparency: Can Retailers Regain Control?” study, can be downloaded at: http://www.retailwire.com/page/10133/.

(This article was commissioned by IBM, which is granted the right of republication. All other rights reserved.)